A while back, I was having lunch with a friend and we were discussing how had begun implementing some financial strategies he had heard about from a financial entertainer on the TV or radio. Now, this person wasn’t offering bad advice but it didn’t apply to everyone. I asked my friend, “Does his advice apply to you and your situation?” Unsure of what I meant, he asked me to clarify so I said, “Is your income common or uncommon? If that advice was intended for the masses, would it apply to your situation?”

My friend is a business owner, but a humble one at that, so he replied that he was an average business owner with an average or slightly better than average income. Realizing this gave my friend a new understanding of the advice this personality was offering on his show. He agreed those making a lot of money probably implement different strategies than he does but those are the “rich folks” living on the east coast.

While this made both of us chuckle, I asked him if he ever envisioned himself being part of the 1% crowd, or even the 10% crowd. With a laugh, he said he would never be there. He’s not alone. Many Americans believe they will never be able to accumulate the amount of wealth they dream of.

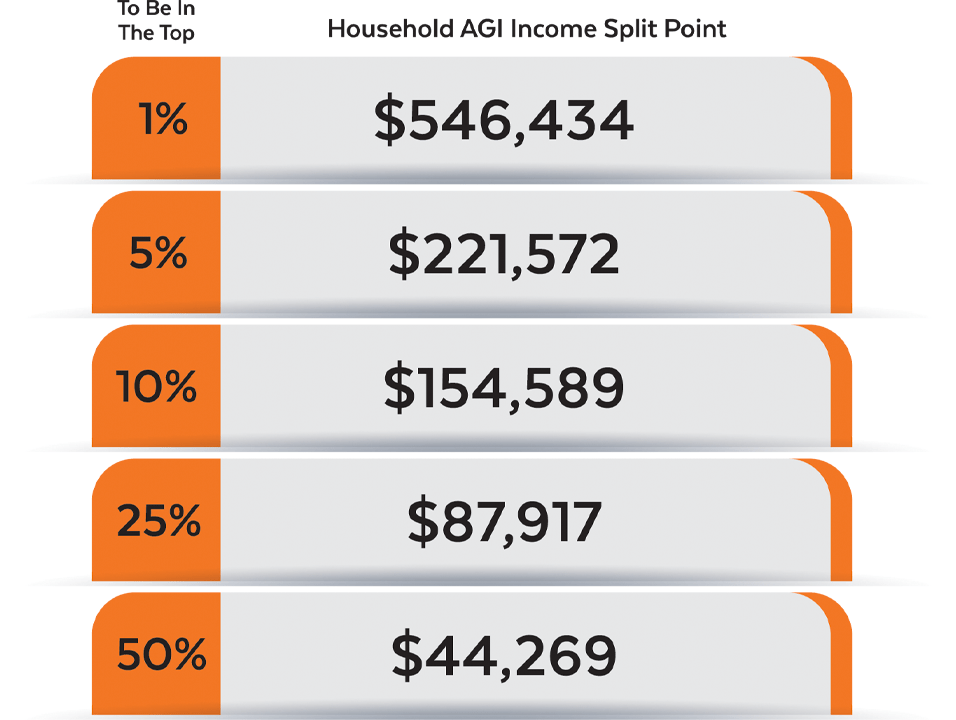

Take a look at the chart above. What do you see? After looking beyond the huge (and unsettling) disparity between income levels, you’ll notice something that may surprise you.

To be in the top 50% of earners, you need to have an annual income of $44,269. Looking at the chart, you’ll see if you’re making between $44,269 and $87,817, you’re already better off than half of Americans. Next, when comparing an annual income of $154,589 to that of a $546,434, you’re likely to notice a huge disparity in those numbers. Rather than feeling discouraged about that, pay attention to where an annual income of $154,589 falls according to the chart; The top 10%! While it may seem impossible to reach a place in the coveted 1%, many Americans are in much higher income brackets than they may have initially thought.

So, the big questions are:

1. Do you want advice packaged for the masses or do you want advice crafted with you and your income level in mind?

2. Are you transferring your wealth unknowingly by implementing common advice on your uncommon income?